Russia Keeps Oil Production Below OPEC+ Quota: A Closer Look at Production, Capacity, and Gas Exports

Russia, a key player in global energy markets and a leading member of the OPEC+ alliance, has maintained its crude oil production slightly below its allocated quota in May 2025, signaling a delicate balancing act amid geopolitical tensions, sanctions, and shifting market dynamics. According to Bloomberg, Russia’s crude output averaged 8.979 million barrels per day (bpd) in May, just 19,000 bpd shy of its OPEC+ target of 8.998 million bpd, reflecting near-compliance after periods of overproduction. This article explores Russia’s oil production trends over the past five years, its compliance with OPEC+ quotas, its potential for additional production capacity, and the trajectory of its natural gas and LNG exports during the same period.

Russia’s Oil Production: A Five-Year Overview

Russia ranks among the world’s top oil producers, alongside Saudi Arabia and the United States, with its oil and gas sector contributing significantly to its economy—10.7% of GDP in 2024. However, Western sanctions following the 2022 invasion of Ukraine, including an EU oil embargo and a $60 per barrel price cap, have reshaped its production and export landscape. To maintain market stability, Russia has adhered to OPEC+ production cuts, though compliance has been inconsistent.

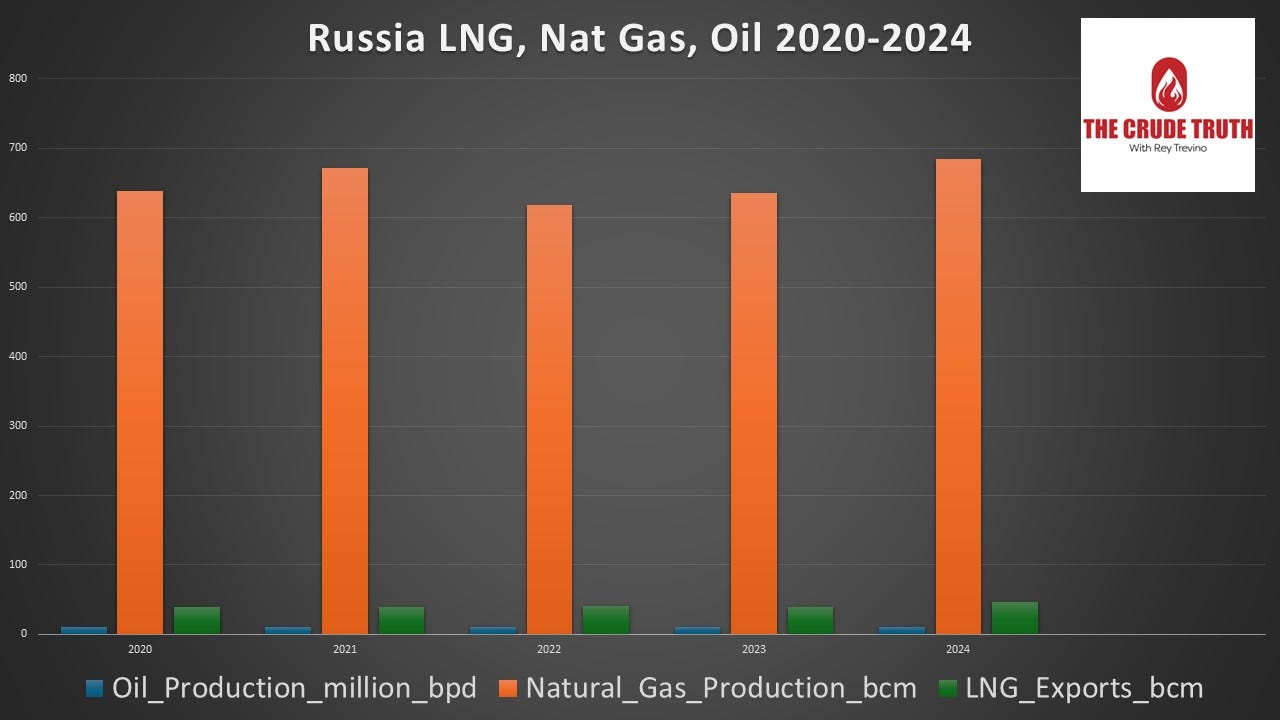

Here’s a snapshot of Russia’s oil production (crude oil and condensate) from 2020 to 2024, based on available data:

2020: 10.27 million bpd

2021: 10.52 million bpd

2022: 10.78 million bpd

2023: 10.58 million bpd

2024: 10.32 million bpd (down 2.8% from 2023)

Sources: Statista, Reuters, OilPrice.com

Production peaked in 2022 at 10.78 million bpd, driven by high global demand and prices before sanctions fully took effect. The decline in 2023 and 2024 reflects OPEC+ cuts, sanctions, and technical challenges, such as high water cuts in aging fields. For instance, many of Russia’s older fields produce significant water volumes, complicating efforts to ramp up output quickly. In 2024, Russia produced 516 million metric tons (approximately 10.32 million bpd), a 2.8% drop from 531 million tons in 2023.

OPEC+ Quota Compliance: A Mixed Record

Russia’s adherence to OPEC+ quotas has been a focal point for market watchers, especially as the alliance navigates supply hikes and compliance issues among members like Kazakhstan. In May 2025, Russia’s output of 8.979 million bpd was nearly aligned with its quota, a marked improvement from earlier overproduction. For example, in April 2024, Russia admitted to exceeding its quota by 154,000 bpd due to “technical reasons,” producing 9.29 million bpd against a target of approximately 9.136 million bpd. Cumulative overproduction from January to June 2024 reached 480,000 bpd, prompting Russia to submit a compensation plan to OPEC, with most offsets scheduled for March to September 2025.

Russian Deputy Prime Minister Alexander Novak has claimed “100% compliance” in early 2025, though independent estimates, such as those from Bloomberg, suggest minor deviations. The classification of production data since 2022 has forced analysts to rely on ship-tracking and secondary sources, introducing uncertainty. Despite occasional overproduction, Russia’s efforts to stay close to quotas reflect its commitment to OPEC+ stability, particularly as oil prices have declined since April 2025, impacting export revenues.

Can Russia Produce More? Assessing Additional Capacity

Russia’s ability to increase oil production hinges on its spare capacity, infrastructure, and the impact of sanctions. While Russia theoretically has room to boost output, several constraints limit its flexibility:

Aging Fields: Many of Russia’s mature oil fields, particularly in Western Siberia, produce high water volumes, making it costly and technically challenging to restart shut-in wells. Analyst Amrita Sen noted that Russia added only 10,000 bpd in April 2025 despite quota room, underscoring these limitations.

Sanctions and Logistics: Western sanctions have disrupted access to technology and financing, hampering field development. The rerouting of exports to Asia, primarily China (47% of crude exports) and India (38%), has increased shipping costs by over $10 per barrel. The use of a “shadow tanker fleet” to evade sanctions further complicates logistics.

Storage Constraints: Russia lacks significant storage capacity for unsold crude, meaning production must align closely with export and refining demand. Tightened sanctions could force output cuts if exports are curtailed.

Despite these challenges, Russia’s Arctic fields, which account for 20% of its crude production, offer long-term potential. The country’s energy strategy projects stable oil production at 10.8 million bpd through 2050, suggesting confidence in maintaining or slightly expanding capacity. However, immediate spare capacity is limited. The International Energy Agency (IEA) estimates global spare capacity is concentrated in Saudi Arabia and the UAE (approximately 2 million bpd combined), with Russia’s contribution likely under 500,000 bpd in the short term. Technical and geopolitical hurdles make rapid increases unlikely without significant investment and sanction relief.

Natural Gas and LNG Exports: A Growth Story

While oil production faces constraints, Russia’s natural gas sector has shown resilience, with production and exports rising despite sanctions. In 2024, natural gas output increased by 7.6% to 685 billion cubic meters (bcm), driven by expanded pipeline exports to China via the Power of Siberia pipeline and a 4% rise in LNG exports to 47.2 bcm. Below is a five-year overview of natural gas production and LNG exports:

2020:

Natural Gas Production: 638 bcm

LNG Exports: 40 bcm

2021:

Natural Gas Production: 672 bcm

LNG Exports: 40 bcm

2022:

Natural Gas Production: 618 bcm

LNG Exports: 41 bcm

2023:

Natural Gas Production: 636 bcm

LNG Exports: 40 bcm

2024:

Natural Gas Production: 685 bcm

LNG Exports: 47.2 bcm

Sources: Reuters, IEA, OilPrice.com

The EU remains the largest buyer of Russian LNG (50% of exports in 2024), followed by China (21%) and Japan (19%), despite sanctions on pipeline gas transit through Ukraine ending in December 2024. Pipeline gas exports rose 15.6% in 2024, primarily to China, which now accounts for 27% of exports. Russia’s long-term strategy targets a threefold increase in LNG capacity to 140 million tons per year (approximately 190 bcm) by 2035, focusing on Arctic and Far East projects.

However, challenges persist. The EU’s reliance on Russian LNG, valued at EUR 673–861 million monthly in 2024, has drawn scrutiny, with calls for tighter sanctions. Sanctions have also limited access to LNG technology, slowing project development. Despite these hurdles, Russia’s proximity to Europe and low-cost Arctic gas reserves position it to compete with global LNG leaders like Qatar.

The Crude Truth is Navigating a Complex Energy Landscape

Russia’s near-compliance with its OPEC+ quota in May 2025 reflects a strategic effort to stabilize oil markets amid declining prices and sanctions. While production has declined slightly over the past five years, from 10.78 million bpd in 2022 to 10.32 million bpd in 2024, Russia remains a formidable producer. Its spare capacity is constrained by aging fields, sanctions, and logistical challenges, limiting short-term output increases. Meanwhile, natural gas and LNG exports are on an upward trajectory, with 2024 marking significant growth despite geopolitical headwinds.

Do not underestimate Russia's ability to drill for as much oil and gas as it needs to sustain its revenue and support its military machine. That being said, I have to look at them having the capability of being very steady in natural gas and LNG, but they might be a little limited on the oil side. Their domestic needs for oil, gasoline, and diesel have been extremely high, and there have been some reports, although unverified, of them not being able to meet their oil production quota.

I am also watching to see how all the OPEC+ members handle the next two months, as it will have the ability to impact oil prices. If they cannot meet the larger quotas assigned by Saudi Arabia, we will know that a chess match is being played out. We have all seen the reports that Saudi Arabia needs $90 oil, and perhaps they were trying to make a point to their members.

For energy markets, Russia’s ability to balance OPEC+ commitments, expand gas exports, and navigate sanctions will shape global supply dynamics. As the Kremlin prioritizes “friendly” markets like China and India, the West’s sanction strategy faces scrutiny for its limited impact on Russia’s oil revenues, which are projected to remain robust at $120 billion for 2025. The interplay of production discipline, capacity constraints, and gas export ambitions will keep Russia at the heart of global energy conversations.

I keep returning to the primary difference between the Russian business model and the United States. We have royalties, private businesses, and employees who want to earn a better life, and Russia is missing out on a lot of that.

Please reach out at any time, leave a comment, or let me know what you would like to hear about next on The Crude Truth.