What is the Impact of the Israel Air Strikes on Iranian Oil and Gas?

Oil is up to $74.23, and where do we go from here?

The recent Israeli air strikes on Iranian military and nuclear facilities have sent shockwaves through global energy markets, reigniting fears of supply disruptions in the Middle East, a region that accounts for roughly a third of the world’s oil production. The strikes, which targeted sites including Tehran’s main gas depot and an oil refinery, have raised critical questions about the immediate and long-term effects on Iran’s oil and gas sector, the trajectory of global oil prices, and the potential for a catastrophic closure of the Strait of Hormuz. This article examines these issues, offering a clear-eyed assessment of the risks and realities.

The Impact on Iran’s Oil and Gas Sector

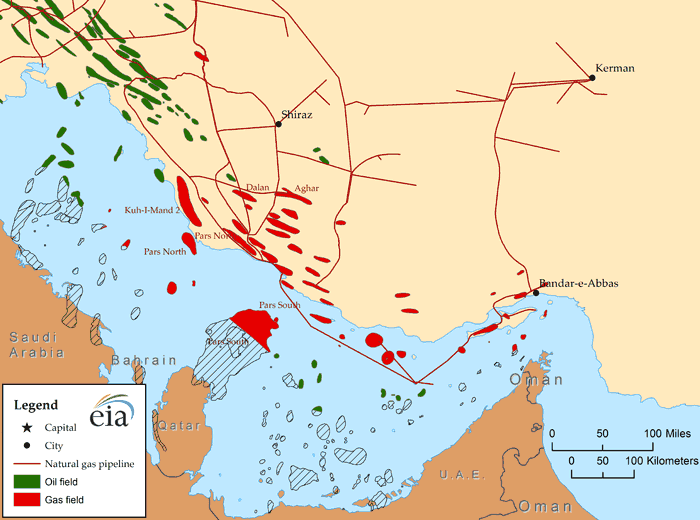

Iran, the fourth-largest oil producer in OPEC, produces approximately 3.3 million barrels per day (bpd) and exports over 2 million bpd, primarily to China. The Israeli strikes, which occurred on June 13, 2025, hit key energy infrastructure, including an oil refinery and the South Pars natural gas field, one of the world’s largest. However, reports from the National Iranian Oil Refining and Distribution Company indicate that damage to refining and storage facilities was limited, and operations continue. Critically, Israel avoided targeting Kharg Island, which handles 90% of Iran’s crude oil exports, suggesting a deliberate effort to limit disruption to global oil flows.

The immediate impact on Iran’s oil production and exports appears minimal, as no significant supply interruptions have been reported. Iran’s ability to maintain exports, particularly to China, remains intact for now. However, the strikes have introduced a risk premium into oil markets, with Brent crude surging nearly 7% to $75 per barrel and intraday spikes reaching as high as 13%, the largest single-day jump since March 2022. This volatility reflects market fears of further escalation, which could target Iran’s export infrastructure or provoke retaliatory strikes on regional energy facilities.

Longer-term, the strikes could exacerbate Iran’s domestic energy challenges. Damage to refining capacity, even if minor, may worsen gasoline shortages, impacting the Iranian public more than global markets. Additionally, heightened geopolitical tensions could deter investment in Iran’s aging oil and gas infrastructure, which already struggles under Western sanctions. If Israel or its allies impose tighter sanctions enforcement, up to 3% of global oil supply (roughly 1.7 million bpd) could be curtailed, pushing prices higher.

Will Oil Prices Range from $75 to $100?

The surge in oil prices following the strikes has brought Brent crude to around $74-$75 per barrel, with U.S. West Texas Intermediate (WTI) settling at $72.98. Analysts are divided on whether prices will climb into the $75-$100 range. Several factors will determine this trajectory:

Escalation Risk: If Iran retaliates by targeting Israeli or regional energy infrastructure, such as Saudi Arabia’s Abqaiq facility (hit by Iranian proxies in 2019), prices could spike toward $100 per barrel. Goldman Sachs estimates that a temporary loss of 1.75 million bpd of Iranian supply could push Brent to a peak just over $90, though prices may fall back to the $60s by 2026 as supply recovers. Capital Economics suggests that targeting Iran’s export facilities could drive Brent to $80-$100.

OPEC+ Response: OPEC+ has spare capacity equivalent to Iran’s output, primarily from Saudi Arabia and the UAE. If Iranian exports are disrupted, OPEC+ could ramp up production to offset the shortfall, limiting price increases. However, Saudi Arabia’s reluctance to flood the market, as seen in past crises, may delay this response, allowing prices to climb temporarily.

Global Demand and Supply Dynamics: Ample global oil supply from non-OPEC countries like the U.S., Brazil, and Canada has reduced the Middle East’s market share, providing a buffer against disruptions. However, sustained conflict could reverse recent declines in gasoline prices, which fell 12% year-over-year in the U.S. by May 2025, potentially pushing inflation higher.

Market Sentiment: The initial market reaction was driven by fear rather than actual supply losses. If tensions de-escalate, as some analysts predict, prices could settle back toward $70. JPMorgan’s Natasha Kaneva argues that sustained prices above $65 risk demand destruction, as consumers balk at higher fuel costs.

While a price range of $75-$100 is plausible in the event of further escalation, most analysts view a sustained climb above $100 as unlikely unless the Strait of Hormuz is disrupted. The current price range of $70-$75 reflects a market pricing in risk but not catastrophe.

Secondary Concerns: The Strait of Hormuz

The Strait of Hormuz, a narrow waterway between Iran and Oman, is the world’s most critical oil chokepoint, handling 18-21 million bpd—about 20% of global oil consumption. Iran’s control of the northern side gives it leverage to disrupt shipping, a threat it has wielded in the past. Posts on X from June 14, 2025, indicate that the Iranian Parliament is “seriously looking at a possible closure” of the Strait in response to Israel’s attacks, though such statements may reflect posturing rather than intent.

A closure or significant disruption of the Strait would be a worst-case scenario, with far-reaching secondary concerns:

Global Supply Shock: A prolonged closure could remove 20% of global crude exports, including oil from Saudi Arabia, Kuwait, Iraq, and the UAE. Estimates suggest prices could double, reaching $100-$150 per barrel, surpassing the 2008 record of $147. Qatar, a major LNG exporter, also relies on the Strait, and disruptions could spike European gas prices, tightening global energy markets.

Economic Fallout: Higher oil prices would fuel inflation, particularly in the U.S., where gasoline prices are a key economic indicator. JPMorgan estimates that oil at $120 per barrel could push U.S. CPI to 5%, derailing the Federal Reserve’s efforts to maintain inflation near 2%. In Asia, China’s reliance on Middle Eastern oil (including 1.5 million bpd from Iran) could drive up costs for manufactured goods, impacting global supply chains.

Regional Escalation: Blocking the Strait would draw the U.S. and its allies into the conflict, as the U.S. military has the capability to reopen the waterway. However, such action could escalate tensions, potentially involving Iran’s proxies like the Houthis, who have disrupted Red Sea shipping. Saudi Arabia and the UAE have pipelines bypassing the Strait, but these are vulnerable to attacks, and Iraq and Kuwait lack alternative routes.

Iran’s Self-Interest: Closing the Strait would harm Iran’s economy, as it relies on oil exports through the same route. China, Iran’s largest customer, would exert economic pressure to keep the Strait open, as disruptions would raise oil prices and strain its economy. Analysts argue that Iran is unlikely to follow through, as the costs outweigh the benefits.

Market Volatility: Even without a full closure, heightened risks in the Strait could increase shipping costs and insurance premiums, adding to market volatility. The UK Maritime Trade Operations has advised vessels to avoid the southern Red Sea and Gulf of Aden, signaling broader regional risks.

Conclusion: A Fragile Balance

The Israeli air strikes on Iran have jolted oil markets, but their immediate impact on Iran’s oil and gas production is limited. Prices have climbed to $74-$75 per barrel, and a range of $75-$100 is possible if tensions escalate, though OPEC+ spare capacity and global supply buffers may cap sustained spikes. The specter of a Strait of Hormuz closure looms large, with the potential to send prices soaring and destabilize global economies. However, Iran’s economic dependence on the Strait and pressure from China make this scenario unlikely for now.

I, for one, do not want to see the United States in another war. We need to get our own house in order and refrain from getting involved. That being said, we are sending the aircraft carrier Nimitz and more tankers to the area this morning. So buckle up, as we are going to need every drop of U.S.-manufactured oil and gas.

Investors and policymakers must remain vigilant. The Middle East’s history of volatility suggests that de-escalation is not guaranteed, and even minor disruptions could ripple through energy markets. For now, the world watches Iran’s next move, knowing that the balance between stability and chaos hangs on a knife’s edge.

I will also have another story out about the fire in the Marathon Oil refinery. That will impact gasoline and diesel prices, as it can produce about 500,000 barrels of oil per day.

Let me know your thoughts on the price of oil, and it seems that the oil bulls are gaining momentum amid the geopolitical issues.

Check out the Crude Truth.com